From around 2010 until 2016, there was a significant growth in biogas and biomethane production in Germany, which has in the years following, plateaued in terms of its growth. Moreover, in May 2023, BMP Greengas began proceedings indicating it might be insolvent, which proved to be the case in August of this year. At the same time, the first half of 2023 saw two of the largest biogas / biomethane producers in Germany, WELTEC* and Deutschen Agrar Holding (DAH), being put up for sale to investors, in addition to E.ON’s purchase of WINGAS’s biomethane product area in 2019 and BayWa r.e. Bioenergy GmbH being sold to Macquarie in 2022. Thus, the past market movements and current developments regarding three large biogas/biomethane firms send conflicting signals, raising the question of how to assess the current state and future of the biogas and biomethane market in Germany.

Positive Signals and Developments

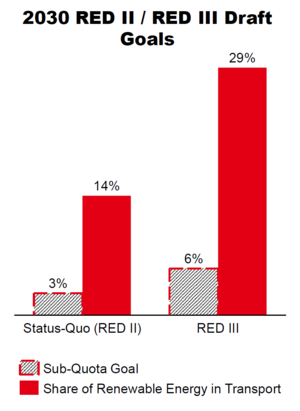

On the macro-level, considering the war in Ukraine and the EU’s goal of weaning itself off Russian gas, the use of biomethane as a substitute has been supported (e.g., the Biomethane Action Plan and the Biomethane Industrial Partnership). Furthermore, the recently published draft of the Renewable Energy Directive (RED) III (1) sends positive signals for the biomethane market in the transport sector, through maintaining double counting for advanced biofuels. Furthermore, the RED II goals for the share of renewable energy in transport and its sub-quota goal for advanced biofuels and renewable fuels of non-biological origin (RFNBO’s) were raised significantly, as seen in the graphic below. The increased ambition stemming from RED III will presumably drive up GHG quota prices in Germany, thus increasing the price of advanced biofuels and therefore, biomethane**. Additionally, growth (albeit slow) has been seen in Germany in the number of bio-CNG/LNG filling stations, and scenarios project market growth for LNG and CNG for heavy trucks until 2035-2040, with a decline thereafter, and sustained growth for LNG until 2050 for ships (inland navigation).

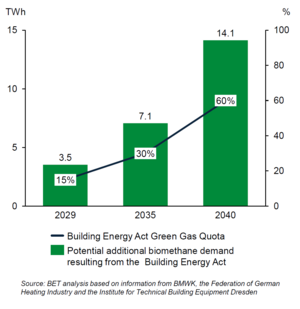

Another positive sign for biomethane in the generation (heat and power) sector is the Building Energy Act (Gebäudeenergiegesetz - GEG), which stipulates that new heating systems must be powered by 65% renewable energy from 2024 onwards and sets goals from 2029 onwards for the use of biogas/biomethane. Thus, the demand for biomethane in the heating sector could increase significantly, as seen in the graphic below.

Likewise, at the industrial level, biomethane shows potential for use in high heat industrial process as a direct replacement for natural gas, thus eliminating any additional CAPEX investments associated with a switch to (green) hydrogen (or other energy carriers).

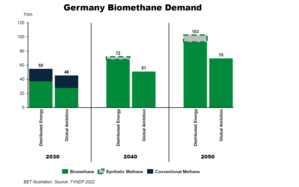

When analyzing the potential of biomethane across all sectors, the European Ten Year Network Development Plan (TYNDP) 2022 forecasts a strong increase in all scenarios for biomethane demand both across the EU and in Germany, as seen below.

Finally, when comparing the biomethane production price to that of green hydrogen and synthetic natural gas, the projected production cost remains below that of substitute energy carriers. For example, green hydrogen production and transport costs are currently far more expensive than those of biomethane. Even when transported with a future European hydrogen backbone, the costs of green hydrogren (2) are expected remain above the costs of biomethane atleast until 2030-2035. Thus, biomethane has a clear cost advantage to other energy carriers from a cost perspective, which is a positive sign for its future demand development.

Negative Signals and Developments

Beginning again with RED II/RED III, there are two developments which are cause for concern in regards to the biomethane for transportation market.

First, since the beginning of 2023, a significant drop in the price of the GHG quota market in Germany has been seen – from ~425 €/tCO2eq to fluctuating around ~250 €/tCO2eq (from the 20th week of the year until the time of writing). This price drop resulted from Germany classifying brown grease in January 2023 as an advanced biofuel**, although it removed brown grease from its Nabisy list a week after it had been classified as such. However, this correction was only editorial, leading to continued double counting of brown grease. This classification has led to strong additional imports of brown grease, which has depressed GHG quota prices, as the GHG quota can be fulfilled for an estimated 200 €/tCO2eq, thus under the current price of ~250 €/tCO2eq. Therefore, questions remain regarding the future development of the biomethane market due to it being highly depending the regulatory environment, both at the EU and German level, which has been in constantly in flux.

Second, due to increasing electrification in the transport market and the triple counting of GHG quota certificates from electromobility, the long-term demand for biomethane in the transport sector is expected to be limited to use in heavy trucks and ships for inland navigation.

Turning to the generation sector, the expected long-term decrease of green hydrogen prices (starting from 2030/2035 onwards) will challenge biomethane in the residential and industrial heat use-cases (e.g., for district heating networks). Likewise, the growth in the electrification of heat (e.g., heat pumps and electric boilers) and the increase capacity buildout of renewable installations (thus, more green electricity) will pose a strong challenge to the use of biomethane as well as other energy carriers in the residential heating.

More generally, another limitation to the future biomethane potential are supply constraints, for which estimates for Germany range between 25-40 TWh for 2030 and 70-100 TWh in 2050. Furthermore, debates remain regarding the environmental benefits of biogas/biomethane, particularly in terms of the emissions resulting from the transport of substrates to the anerobic digesters. Additionally, with the increase in the use of chicken (and other animal manure) for the production of biomethane (in order to be RED II Annex IX Part A compliant), criticism has been leveled questioning the sustainability of using manure for biomethane production. This is due to the fact that while previously, farmers would either pay to have manure removed or give it away for free, an entire market now exists for the sale of manure to biomethane producers, thus in some ways incentivizing animal farming which itself is a large emitter of greenhouse gases. Although using waste products such as manure is in theory advantageous and supports a circular economy, the entire ecosystem of factory/mass animal farming and their emissions is not sustainable long term if net zero goals are to be reached.

The Future of the Biogas/Biomethane Market in Germany

With the biogas/biomethane sector currently in flux, there seems to be momentum towards consolidation (i.e., mergers and acquisitions) of the major market players, as they are willing and able to bear the risk of market volatility. On the one hand, use cases in both the residential and industrial heating sectors, as well as more narrow use cases in heavy transport create a baseline level of demand which is not expected to disappear. On the other hand, uncertainty remains in the middle- to long-term regarding the sustainability of biomethane, particularly in terms of the substrates used for its production, as well as increasing competition from other energy carriers. Thus, it seems that the trajectory of the biogas and biomethane markets will be decided in the years until 2030, either by firmly establishing itself as a crucial part of a carbon neutral world where green molecules are a foundational building block, or rather taking a more backseat role with electrification in the driver seat, supporting the transition but in a more auxiliary fashion.

*BET was the lead commercial advisor for one of the interested parties in the WELTEC M&A process.

**RED II Annex IX Part A compliant

(1) European Parliament. (2023, September 12). Renewable Energy Directive (P9_TA(2023)0303). www.europarl.europa.eu/doceo/document/TA-9-2023-0303_EN.pdf

(2) Hank, C., Holst, M., Thelen, C., Kost, C., Längle, S., Schaadt, A., & Smolinka, T. (2023). Site-specific, comparative analysis for suitable Power-to-X pathways and products in developing and emerging countries. Fraunhofer Institute for Solar Energy Systems ISE. files.h2-global.de/H2G_Fraunhofer-ISE_Site-specific-comparative-analysis-for-suitable-Power-to-X-pathways-and-products-in-developing-and-emerging-countries.pdf